What do lemons and used cars get you? For, Joseph E. Stiglitz and George A. Akerlof, a Nobel prize in economics. But, with Advocate, much better pricing on insurance policies for borrowers, which means more business for lenders.

Property insurance is not getting cheaper. In fact, there has been a lot of talk around big insurance companies trying their best to increase premiums in response to soaring inflation. And when they aren’t able to do that, mostly due to state regulation, they are reconsidering their business in entire states. Where does that leave lenders? Sitting on the curbside watching the sun go down on new and old business waiting for a Hail Mary. Sounds gloomy, doesn’t it?

It certainly is gloomy if you are on the phone with multiple borrowers every day listening to them talk about how finding cheaper options, if at all, when insuring their next property or renewing an existing one is getting difficult by the day. Before we talk about what you could do instead, let’s explore the factors which affect insurance premiums and the ability of insurers to offer coverage.

Reasons for expensive insurance

Insurance broadly is split up into two main segments. The provider side, which is the insurer, and the insured side, which is the borrower. Climate change has caused problems on both sides of the spectrum. Greater frequency and higher average damage from hurricanes, floods, and wildfires have made things so bad that a healthy number of insurers have filed for bankruptcy protection during the past few years.

On the other hand, rising costs of materials, labor, and other factors related to property repair and replacement have contributed to higher insurance premiums. As inflation affects the overall economy, insurers find it challenging to maintain affordable coverage levels leaving them no choice but to increase their prices.

Insurers often rely on reinsurance to spread the risk associated with large claims. However, reinsurance costs can increase when there's a surge in claims from catastrophic events. These increased costs can be passed on to policyholders, resulting in higher insurance premiums. With no end in sight for the Fed constantly raising key interest rates, investors have other lucrative options such as treasury bills rather than investing in insurance derivatives. Additionally, and for the same reason, for reinsurers to keep funding new insurance policies, the cost of capital is being directly affected.

The prevalence of insurance fraud and the cost of legal disputes has also greatly contributed to higher insurance costs. Litigation surrounding property claims, liability cases, and disputes over coverage terms can lead to increased expenses for insurers, which can be reflected in higher premiums for policyholders. Although some state governments, such as Florida’s, have passed sweeping legislation to reduce such occurrences, other states, like California, lag so far behind that insurers have started leaving them entirely.

What we’ve covered so far is factually correct. However, the US insurance market for properties suffers from the lemon problem that is often used to best explain informational asymmetry in markets.

Essentially, it occurs when the amount, quality, or level of access to information available to buyers and sellers is not the same. This causes either party an unfair advantage over the other resulting in opaque pricing for goods and services. Advocate has built its platform from the ground up to tackle this specific problem and in turn promises to equip buyers of insurance products with up to date, real-time pricing data. By helping borrowers find better deals on insurance policies, lenders can work easier and faster with borrowers when requiring them to comply with certain insurance requirements which normally add several thousands in premiums.

Let’s see how we do it.

Advocate's data

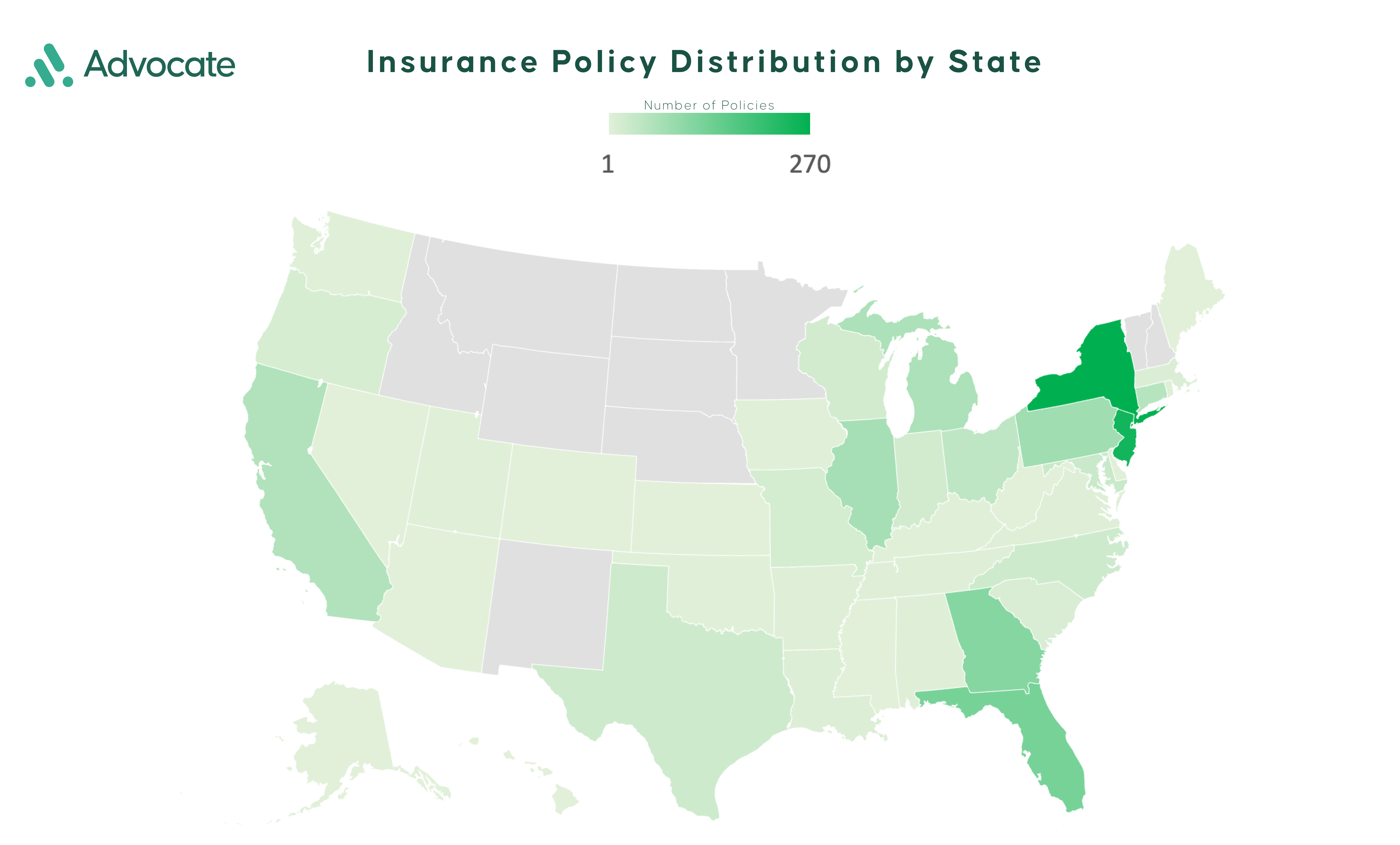

Being a market leading insurance consultant, Advocate processes more than:

-

1,363 policies on a monthly basis from clients

-

from more than 41 states

-

for properties located in over 727 zip codes

-

Insured by 189 carriers.

This handling allows us access to an unparalleled pool of raw insurance policy data. Each policy that gets processed through Advocate goes through a structured dissemination activity which produces more than 50 data points per policy of which the major ones include the premium, dwelling limit, carrier name, and property zip codes. Our existing platform offers lenders access to this database in the form of pricing benchmarks for high, low, and average figures.

Advocate’s analysis

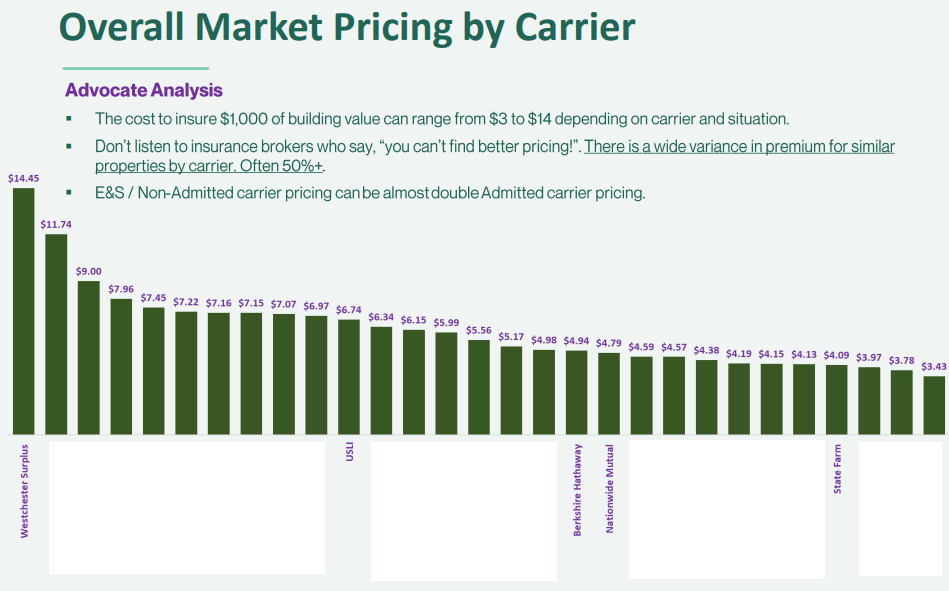

Our research and analysis have consistently showed that cheaper insurance options are almost always available and the age-old broker phrase “You won’t find it cheaper!” no longer holds much merit.

To put things differently, you couldn’t buy a car with today’s certainty in pricing 30 years ago due to the absence of price comparison tools like autotrader.com. Imagine the extent of informational asymmetry during that time when you had next to nothing to compare the pricing to. Fast forward to today and we have hundreds of thousands to pay in insurance premiums and we have nothing like autotrader, at least not yet. But it’s nearly there.

Our database allows us to map pricing trends by zip code, city, state, carrier, broker, property type, policy type and several other factors enabling us to share these insights with lenders who may be having issues getting their borrowers to purchase additional insurance in order to become or stay compliant.

How our clients benefit

If you have questions like the following, Advocate can help answer them today.

-

What’s the average benchmark price for a multi-family property valued at $12,000,000 in the Florida panhandle?

-

How much more expensive, on average, is insuring a condo complex in upper Manhattan as compared to Long Island?

-

Which brokers are offering insurance for old age care facility complexes in the San Francisco Bay Area?

Advocate offers answers to these questions because it has real time access to up to date information based off of policies that property owners have acquired as recent as last month. An example of the dataset we have is given below in the form of the average pricing offered by carrier to insure $1,000 in property value.

Closing comments

The US insurance market no longer needs to experience informational asymmetry and lenders need not experience a drop in business simply because their borrowers can’t find better insurance deals.

Advocate is determined to deliver on its promise of price transparency. Talk to one of our agents today and experience sitting in the best seat at the negotiating table knowing fully well that your borrowers have access to much cheaper insurance.

| Check out our Waiver Templates | Ask any question here | View our upcoming Webinars and Events |