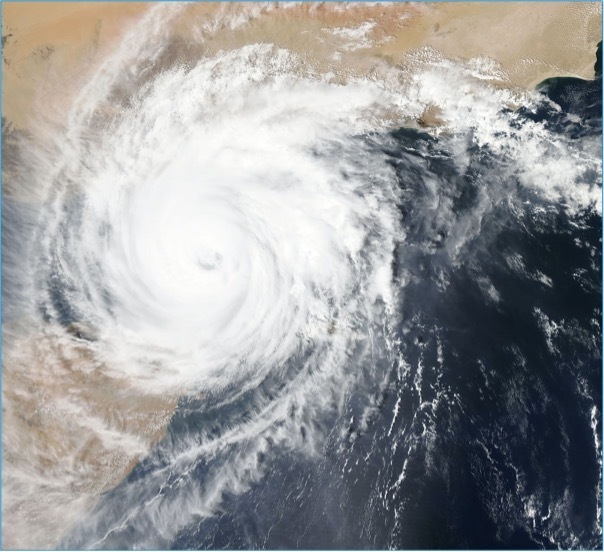

In recent years, climate change has caused severe damage to the Earth’s ecosystem. It’s paramount to understand that these changes and damage are now transitioning into natural disasters worldwide. In the United States (US), the adverse effects of climate change include unprecedented snowfall and the risk of flooding in California and hurricanes in Florida.

Where such natural disasters carry negative implications pertaining to the daily lives of the affected, their impact on loan portfolio performance is also evident. Hurricanes and floods lead to the destruction of property and loss of income. Recent reports have shown that Hurricane Ian either impacted or damaged over 80,000 properties in the affected areas and led to damages and economic losses worth $112 billion (about $340 per person in the US).

In addition, the number of unemployed individuals in Florida after Hurricane Ian witnessed an increase of 19,000. Considering these statistics, it can be stated that a large number of residents faced financial difficulties. Such difficulties, regardless of the region, have had a significant impact on the loan portfolio performance of real estate lenders.

Identifying Vulnerabilities

To understand the impact of hurricanes and floods on loan portfolio performance and how to optimize that performance, it's essential to comprehend what makes a loan portfolio vulnerable. For example, the attractiveness of some loan portfolios is significantly influenced by the credit rating agencies’, such as Moody's, rating they receive. Along with the portfolio's expected losses, for example, Moody's also rates mortgage portfolios based on their MILAN framework. However, portfolios not rated by any CRAs are exposed to the same risks.

Properties with close geographical proximity to hurricanes and floods carry a greater risk of being damaged or completely destroyed. In addition, such events may include a recession-like economic environment leading to a negative impact on the portfolio’s rating, attractiveness, and performance.

Another potential vulnerability is that properties exposed to risks of flooding or hurricane require additional insurance coverage. This makes such properties or mortgages unattractive to potential buyers. In fact, 56% of respondents to a recent survey have said that they would not prefer moving to a location where flood insurance is required. If such properties are the bulk of a loan portfolio, they can negatively influence its performance.

In addition, properties in hurricane or flood-prone regions, or loans pertaining to these properties may not always meet the very stringent conforming requirements set forth by the two government-sponsored entities (GSEs), Fannie Mae and Freddie Mac.

Although such loans are available, they can be risky for mortgage and commercial real estate lenders as they’re not backed by the GSEs, meaning that if the borrower defaults on a loan, there is no government guarantee that the loan will be repaid. Adding such loans to a portfolio makes it vulnerable, as it may lead to more than expected losses.

Hurricanes, Floods, and Loan Portfolio Performance

Hurricanes and floods result have a significant impact on loan portfolio performance. Such natural disasters can increase borrower defaults and delinquency rates. Recent reports have now highlighted that Hurricane Harvey, which struck Texas, flooded more than 300,000 structures and 500,000 vehicles, leading to damages worth $125 billion. In addition, Hurricane Maria, which struck the Caribbean Islands, resulted in damage worth $94 billion (about $290 per person in the US) and forced over 130,000 residents to relocate.

Research studies have examined the impact of both Hurricane Harvey and Hurricane Maria on loan delinquency. Such studies highlight that Hurricane Harvey caused a 20-base point (bps) per quarter increase in the first 180-day delinquency rate. Whereas the impact of Hurricane Maria was much more severe as the delinquency rate increased by 50 bps per quarter. In addition, reports have also highlighted that 65% of the Hurricane Maria-induced borrower delinquencies occurred due to the damage-adjusted LTV and an increase in initial claims.

As mentioned, properties prone to hurricanes and floods are less attractive, and may drag down the performance of a loan portfolio. Speaking about the attractiveness of properties that were or could have been exposed to Hurricane Ian, Dave Burt, CEO of investment research firm DeltaTerra Capital, said:

“An observation of the highest frequency fundamental data on home sales and home inventories indicates that things are definitely going south for these exposed properties.”

In addition, properties in the US housing and commercial real estate market that are at risk of flooding can also negatively influence the loan portfolio performance. Studies have shown that such properties are overvalued by up to $237 billion. Such statistics entail that these properties are being acquired or invested in at a cost that’s higher than their actual valuation, and this may lead to loan portfolio losses in the future. This is because reinsuring these properties may occur at much lower valuations. This will cause insurers to not be able to offer policies that reflect the original loan amount and thus not meet the insurance requirements set by lenders.

However, regulatory changes largely under the purview of the Department of Housing and Urban Development (HUD) and imposed by the Federal Housing Finance Agency (FHFA) now require GSEs to consider climate change as a risk factor when underwriting loan policies. Such changes mean that private real estate lenders may be able to secure government-backed loans for high-risk properties allowing them to minimize the negative implications of hurricanes and floods on loan portfolio performance.

Real-Life Examples of Mortgage Lenders Dealing with Hurricanes and Floods

As mentioned, hurricanes and floods lead to devastating financial circumstances for borrowers limiting their ability to repay loans. Such a situation may lead to loan defaults, negatively impacting loan portfolio performance. However, in recent years, mortgage giants Fannie Mae and Freddie Mac have stepped in to limit the impact of the natural disaster on borrowers and lenders.

Reports have highlighted that mortgage giants allowed borrowers to delay repayments, for example in the case of Hurricane Ian, for up to 12 months without being charged late payment penalties. In addition, foreclosure filings and other legal proceedings have also been suspended in certain cases. Furthermore, Fannie Mae also stated that those affected by the natural disaster could seek mortgage assistance, and forbearance plans were also made available.

Conclusion

The adverse effects of climate change induced hurricanes and floods lead to a transitional impact on loan portfolio performance. Such an impact may include property or economic damage worth billions of dollars and loss of thousands of jobs. These results were evident in the aftermath of Hurricane Ian, Harvey, and Maria.

Hurricanes and floods do have a negative impact on loan portfolio performance. However, regulatory changes and assistance from GSEs may help limit the severity of the impact.

| Check out our Waiver Templates | Ask any question here! | View our upcoming Webinars and Events! |