Summary

This two-part analysis delves into the insurance compliance process for mortgage lenders. Part 1 explores the correlation between insurance compliance turnaround time and five determinants commonly linked to extended approval timelines. In Part 2, our focus shifts to investigating the impact of insurance brokers in shaping these timelines.

Insights from Advocate’s Reviews

At Advocate, our cutting-edge technology and expert insurance review team consistently outperform industry standards in expediting insurance compliance processes – a crucial step in facilitating loan closings. Despite these advancements, variations persist in compliance and resolution turnaround times across different deals.

The insights presented in this analysis are derived from our insurance reviews conducted over the past 12 months. The dataset encompasses all approved loans across various loan programs and lenders.

The key metric under evaluation is the turnaround time on insurance compliance, representing the duration from the initial submission of a loan for insurance review to the final approval granted by Advocate. This timeframe stands as a critical metric for assessing the efficiency and speed of the insurance approval process within our operations.

Loan Processing Time Distributions

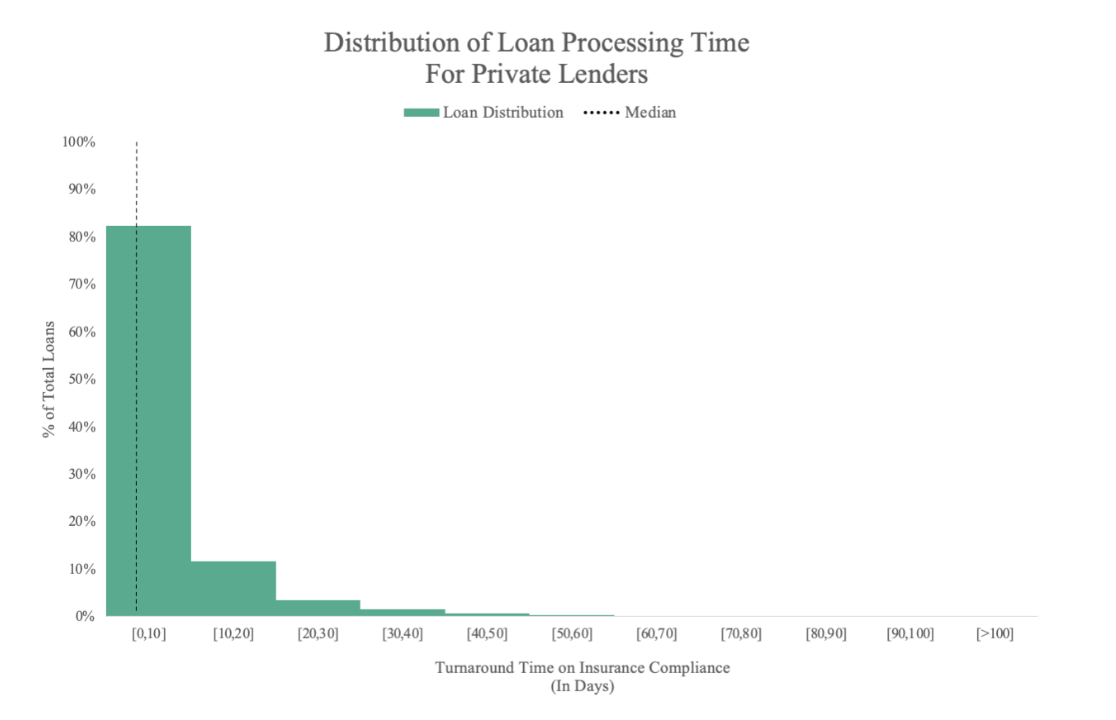

Private Lenders:

Based on the extensive review and approval of thousands of loans at Advocate, a notable trend emerges among private lenders. The majority of loans, upon submission to Advocate’s review team, close within a week to 10 days, displaying a right-skewed distribution. This swift closure can be credited to Advocate’s team promptly resolving compliance issues and the less stringent insurance requirements established by the lenders, facilitating expedited processing and insurance approvals.

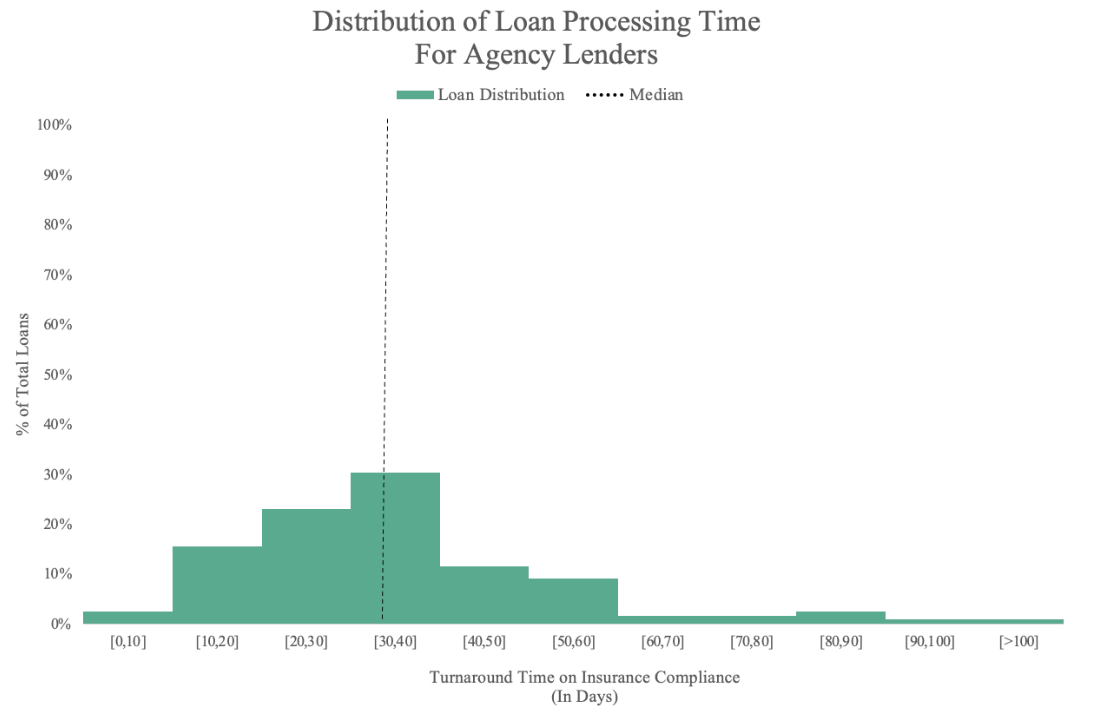

Agency Lenders:

In contrast, loans managed by agency lenders exhibit a more diverse distribution, showcasing a less predictable loan processing time. On average, resolution times – the period between loan submission and insurance approval – are extended, frequently exceeding a month in numerous instances. This variability can be attributed to the intricate nature of navigating the more complex and stringent insurance requirements mandated by agencies like Freddie Mac and Fannie Mae, resulting in extended turnarounds to address compliance issues.

As we navigate through these differences in loan processing times between private and agency lenders, it prompts a closer look at other influential factors to better understand the intricate mortgage approval landscape.

Exploring Key Turnaround Factors

In this section, our focus shifts to potential factors influencing insurance compliance and loan approval timelines. At Advocate we not only use technology and automation to expedite insurance reviews, but also gather insightful data on factors that impact review speed.

By analysing data on these determinants, our goal is to better understand the duration of insurance review processes and identify lenders' pain points to drive improved results. Specifically, we investigate the correlation between turnaround times and insurance limits, insurance market dynamics, waivers issuance, and the necessity of flood coverage.

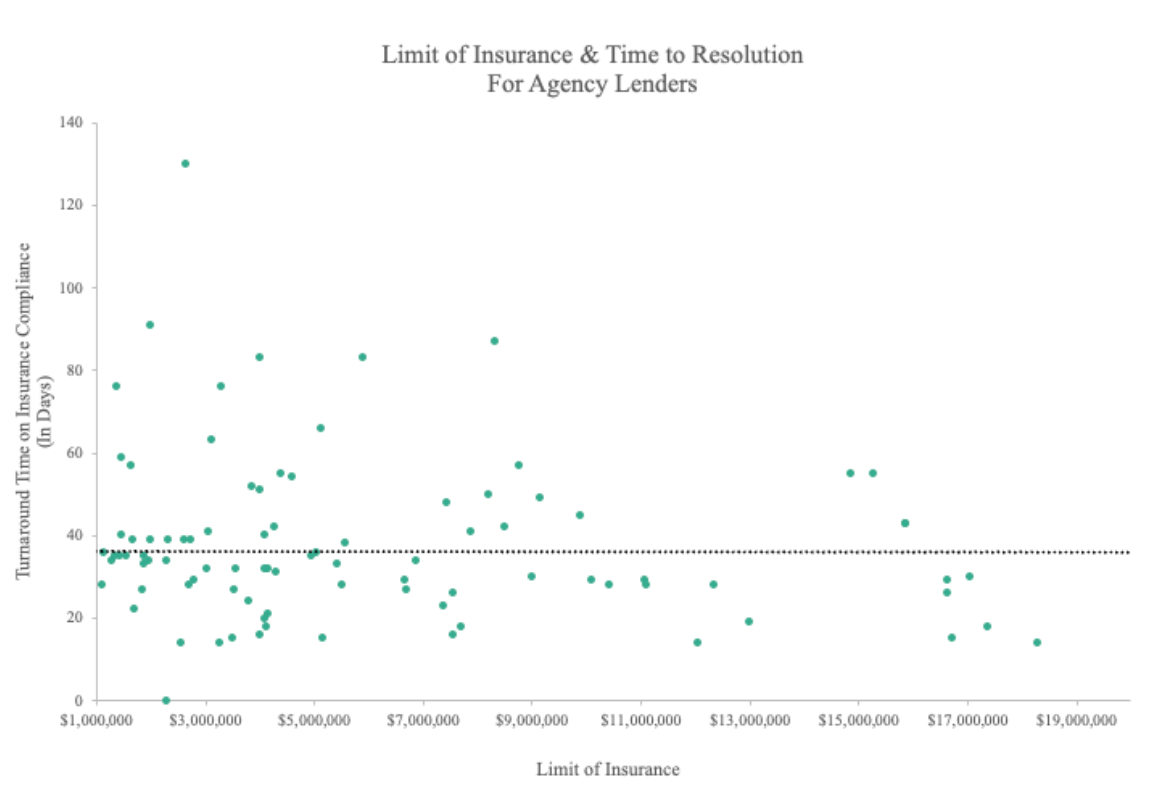

Insurance Limit:

A critical aspect of an insurance compliance review is the insurance limit. The common assumption links higher insurance limits to larger loans and increased property values, often based on replacement cost values.

However, our data on thousands of policy reviews contradicts this assumption. Our analysis, visually represented in the accompanying graph, reveals a notable absence of a clear connection. In fact, there is no direct correlation between mandated insurance limits, set to meet lenders' requirements, and the time needed for resolving insurance compliance. This finding challenges conventional beliefs, offering a more nuanced understanding of the complexities inherent in insurance compliance timelines.

Insurance Market Dynamics:

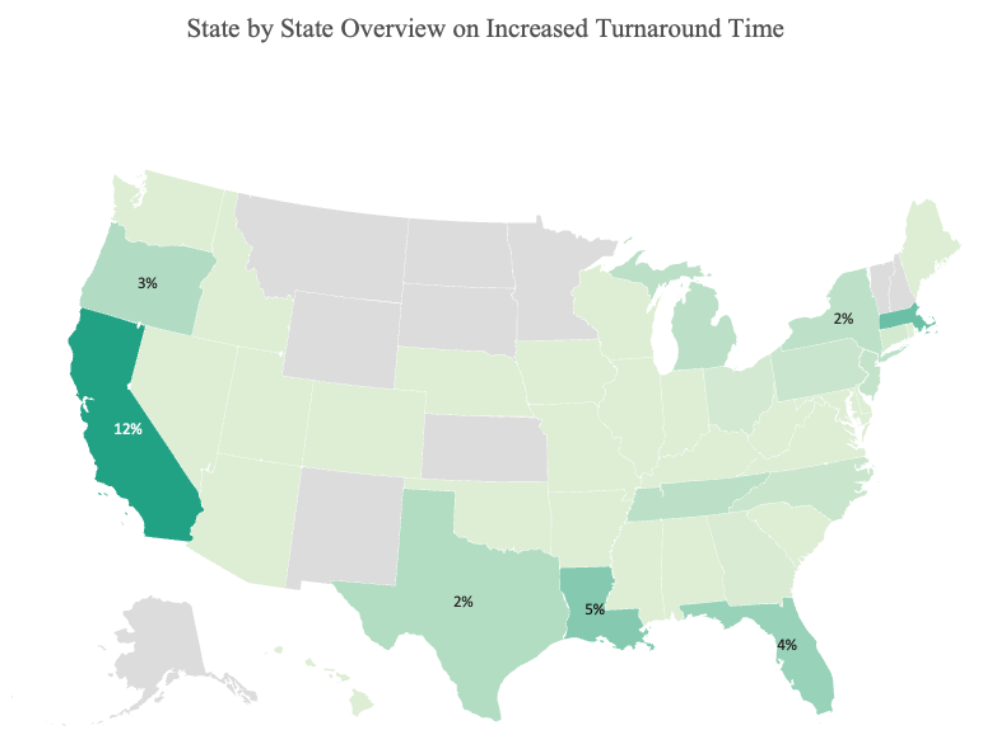

States like Florida and California are known for their challenging insurance markets. While loans in these states are commonly linked to extended approval timelines, our analysis reveals a different perspective.

The accompanying map above illustrates loans with turnaround times exceeding the average. California exhibits relatively higher percentage of such instances. However, other states, including Florida, show significantly fewer occurrences, with merely 4% of loans surpassing the average threshold.

Our findings also reveal that states classified as Tier 1 hurricane-prone areas surprisingly do not experience prolonged approval timelines. This contrast challenges the conventional belief that associates specific geographical locations with extended approval processes, providing a new perspective on the dynamics of insurance compliance in hurricane-prone regions.

Waivers:

In the context of Freddie Mac and Fannie Mae loans, the processes involving drafting, submitting, and obtaining waivers are often perceived as potential contributors to delays in insurance approval. Notably, loans requiring waivers often experience slightly longer approval timelines. In fact, our analysis show that for agency lenders with extended turnaround times, 20% of the loans were approved with a waiver.

Flood Coverage:

Contrary to the belief that requiring flood coverage and its subsequent insurance review may lead to delays in approvals, our analysis show no clear correlation between flood coverage and the approval timeline. Specifically, agency lenders that experienced extended turnaround times on their loans required no flood coverage. Similarly, for private lenders, only less than 5% of the loans necessitated flood coverage. These findings suggest that flood coverage requirement does not significantly impact the overall approval process.

Conclusion

In summary, our analysis explores the diverse factors shaping insurance approval timelines. At Advocate, our technology not only significantly increases efficiency and accelerates loan approvals, but also collects crucial data to further streamline and optimize insurance review processes for lenders and their borrowers. Factors like insurance limits, geography, waivers, and flood coverage provide only a partial view on the turnaround times. We aim to unravel the larger story by investigating the pivotal role of insurance brokers in approval timelines in Part 2 of our analysis.