On Thursday September 14th, our CEO & Co-Founder Ashwin Agarwal, VP and industry expert Kristine Economus were accompanied by David Zemlin, a distinguished Commercial Lines Property & Casualty Agent from Insurance Office of America (IOA) in Boca Raton, FL.

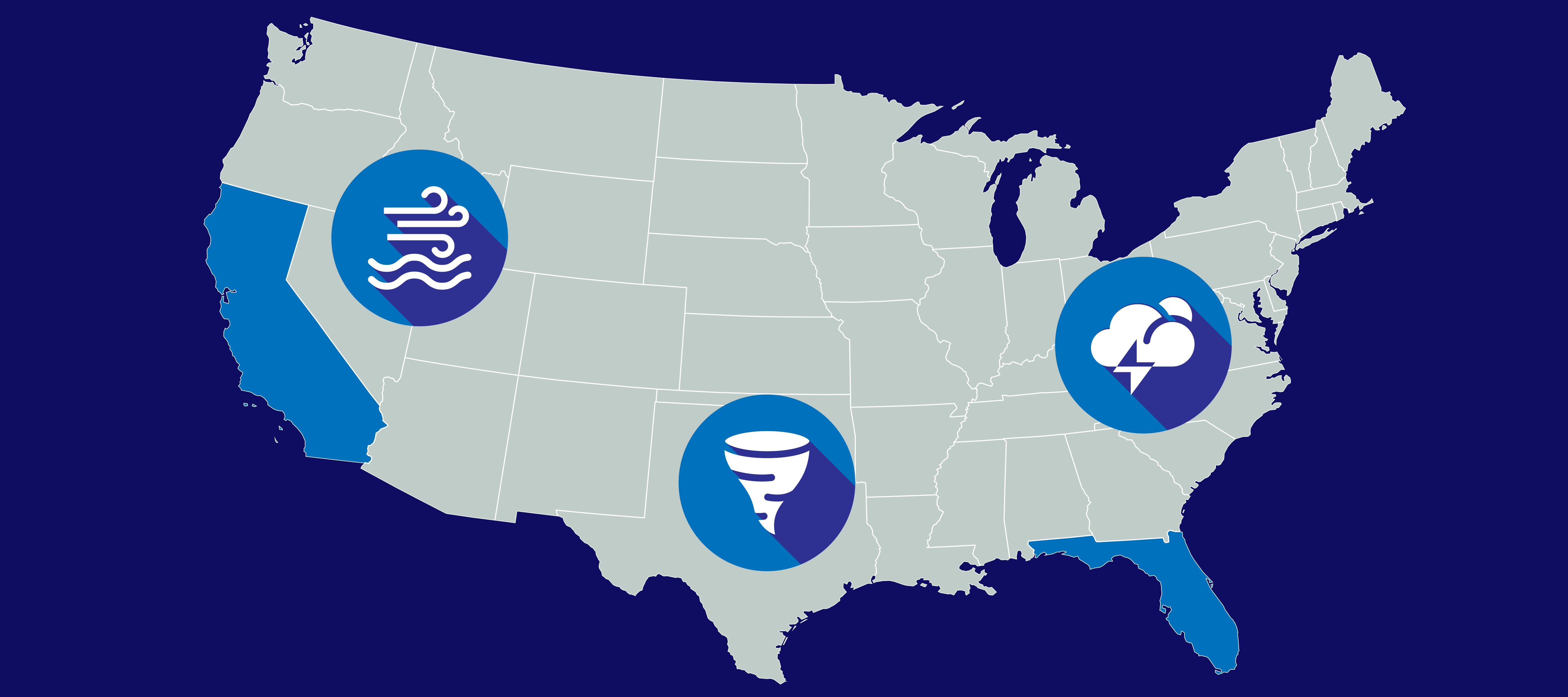

Together they discussed the intricate challenges arising from the evolving landscapes of high-risk states, particularly Florida and California. View the full Webinar recording below 👇

Here are the main points that were discussed over the session:

Market Background:

- The hard market in Florida insurance began in 2017, following several hurricane-free years.

- In 2022, Hurricane Ian and the Champlain Tower Collapse in Surfside led to an overreaction in the insurance market.

- Litigation and fraud emerged as primary drivers of the current challenges, with five carriers going out of business due to lawsuits.

- Rising interest rates have diverted investment away from insurance, posing a permanent challenge.

Homeowners' Insurance Issues:

- Homeowners' insurance claims were highlighted as a significant concern, accounting for 9% of all claims but contributing to a staggering 80% of all lawsuits.

- An extreme example featured a 2-attorney law firm that managed to file 9,000 property damage claims over five years, leading to legal action from Citizens, Florida's state-run insurer.

Litigation Drivers:

- The discussion delved into the mechanics of the litigation problem in Florida, where groups of public adjusters, roofing contractors, and attorneys formed joint ventures.

- They actively solicited property owners to transfer their rights on their insurance policies, a practice known as "assignment of benefits."

- After replacing roofs, they systematically sued insurance carriers, resulting in an unsustainable level of litigation.

- It was noted that Florida was at the epicenter of the litigation funding issue, with firms like Burford Capital investing hundreds of millions in lawsuits, allowing law firms to pursue numerous cases targeting specific jurisdictions, court circuits, and litigation types.

Senate Bill 2-A:

- Senate Bill 2-A aimed to address the property market's challenges with two significant provisions:

- Prohibition of assignment of benefits.

- An end to one-way attorney fees, meaning that insurance carriers can now sue for their attorney fees if a case is dismissed for being frivolous.

Impact of Legal Changes:

- The immediate impact of eliminating one-way attorney fees was still uncertain. However, it was suggested that this change might encourage more insurance companies to reconsider Florida as a market over time.

Insurance Coverage Factors:

- The age of a property was highlighted as a critical factor in obtaining insurance coverage in Florida. Properties built in 2010 or newer were considered the most desirable.

- Additionally, proximity to water bodies and barrier islands played a crucial role in determining insurability. Pre-1980s properties were identified as particularly challenging to insure.

Citizens Florida:

- Citizens Florida was discussed as an option, offering full limits of coverage. However, it was emphasized that their underwriting process was rigorous.

- Citizens offers wind-only or multi-program coverage, excluding water damage, which presents a significant issue for agency compliance.

- The complexities of property inspections and the timing of approvals were identified as challenges when dealing with Citizens.

Timing and Approval:

- The approval process with Citizens varies highly, but usually takes approximately 60-90 days (around 3 months), and coverage could be retroactive for renewals.

- The importance of securing private market quotes was stressed, as these quotes could expire if not acted upon promptly.

Approval Challenges:

- Factors that could affect approval by Citizens included the quality of roof inspections, open claims with unrepaired damage, and unfavorable loss or damage records.

Citizens Binding Quotes:

- It was clarified that signed quotes issued by Citizens were not binding. They often provided test quotes.

Citizens as an Option:

- While Citizens was considered a viable option for average Florida properties, it was acknowledged that the possibility of declinations still existed. Waiting for the private market was not necessarily the best approach.

Timing Matters:

- The importance of acting promptly was highlighted, as quotes from insurers were typically valid for 15-30 days, and terms could change. Being proactive was recommended.

State-Wide Solutions:

- The possibility of putting pressure on Citizens to become a more readily available insurance option due to its status as a state program was discussed. However, it was noted that such pressure may not be well-received, as efforts were concentrated on supporting the private insurance market.

Market Outlook:

- The discussion provided a cautiously optimistic outlook, suggesting that the sharp rate increases of 100-200% might slow down, with the entry of new carriers offering potential relief.

Parametric Insurance:

- Parametric insurance is not viewed as a comprehensive solution. It was emphasized that it should not replace traditional insurance coverage. Its limitations, particularly its claim trigger based on wind speed (sustained for 60 seconds), were highlighted.

- The recommendation was not to rely solely on parametric insurance but to consider it as a hedge in cases where no other coverage was available.

Summary:

- Key takeaways included focusing on litigation claims, monitoring the regulatory environment, watching for additional capital entering the market, strategically timing Citizens applications, considering the age of the building, being cautious with pre-2000 properties, and recognizing that parametric insurance is not a solution or alternative to property insurance.

- Effective communication with clients was emphasized throughout the discussion as an essential aspect of navigating the complex Florida insurance market.

If you have any additional questions, leave a comment below!

| Ask the Community any question here | View our upcoming Webinars and Events |