Summary

Expanding on the analysis of insurance approval timelines in Part 1, Part 2 unveils the crucial role of insurance brokers. Advocate’s comprehensive analysis of review times across our 20,000+ reviews reveal striking variations in approval timelines among different broker categories. What does this mean for lenders? Identifying the insurance broker for your borrower early and seeking Advocate's (or your existing consultant's) opinion on the broker's responsiveness and professionalism are the fastest way to determine if there will be issues within insurance.

Advocate’s Data-Driven Insights

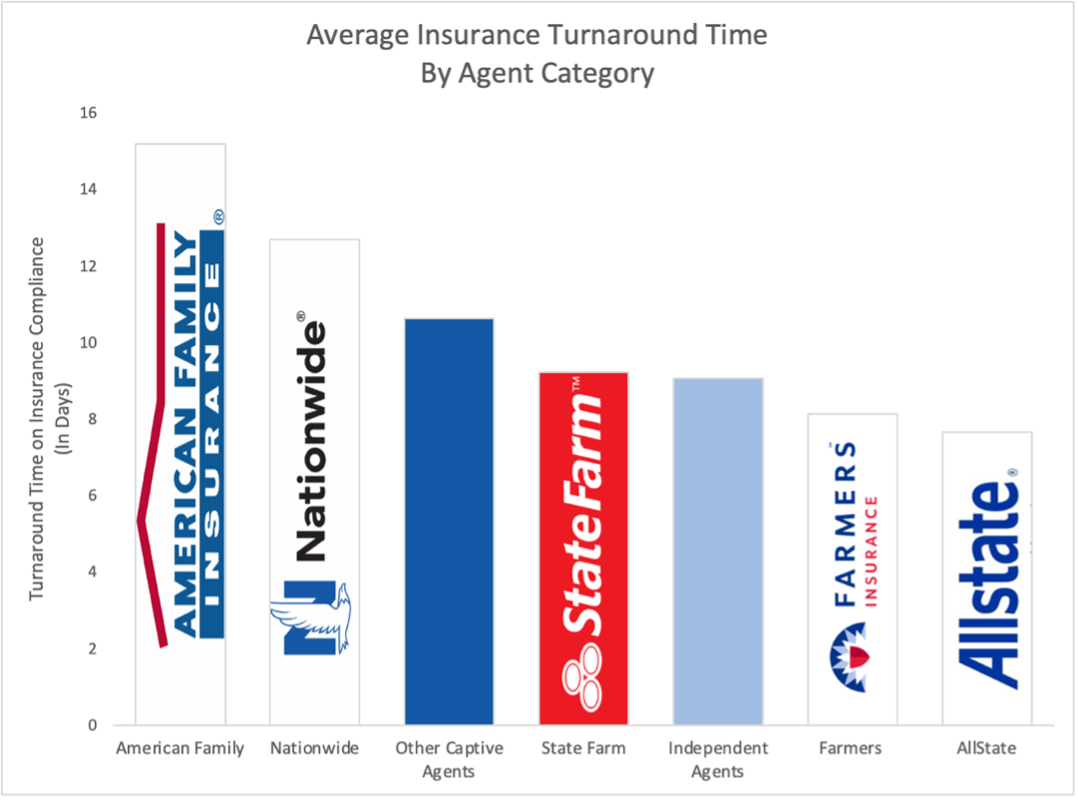

Diving into Advocate’s extensive dataset, we identify substantial disparities in approval timelines among various insurance broker categories (see Methodology section). A low significance level, represented by a p-value, suggests these variances are not merely random chance, indicating the impact of broker categories on insurance compliance approval timelines.

This underscores the importance of strategic broker selection for lenders seeking efficient approval processes for their borrowers, providing valuable insights into optimizing workflows in mortgage lending.

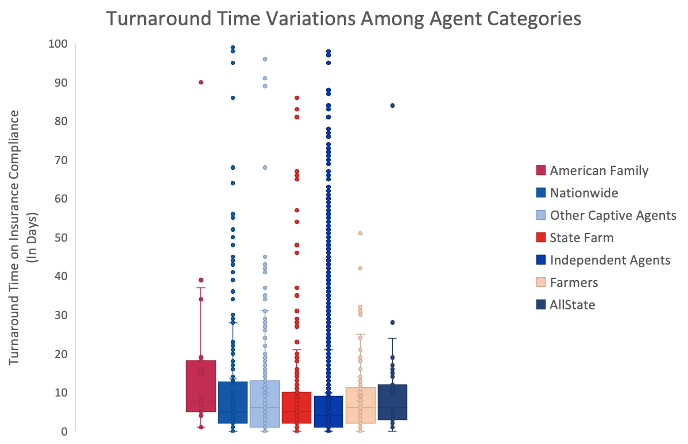

Building on our analysis, we examine how turnaround times vary within the different agent categories. Independent agencies, along with American Family and Nationwide agencies, demonstrate significant variability in their performance, suggesting meaningful differences in efficiency. In contrast, Farmers and Allstate agencies exhibit more consistent turnaround times, showcasing less variation.

Interestingly our box-plot analysis shows that Nationwide and independent agents occasionally experience unusually high turnaround times compared to their typical performance. This highlights the wide range of turnaround times within each agent category, with certain agencies experiencing more extreme cases.

Factors Shaping Broker Variance

Christina Dionelli, an Insurance Consultant at Advocate, emphasizes the importance of collaboration and effective communication, noting, "Certain agencies stand out for their quick responses, often achieved through collaboration among multiple individuals involved in a loan insurance process. However, aligning with the right contacts can pose challenges, making communication crucial for success within our industry.”

Our insurance reviews highlight the significant role of insurance brokers in determining loan approval speed. Broker responsiveness to reviewer feedback, coupled with their adaptability to comply with specific lender requirements, directly influences approval timelines. For borrowers, engaging with brokers who provide tailored and affordable coverage is crucial in expediting overall approval processes.

Advocate’s Commitment to Data-Driven Progress

Leveraging insights from insurance reviews (covering premiums, waivers, exclusions, resolution timelines), Advocate is dedicated to refining industry practices. Our focus on data collection and analysis aims to enhance the insurance compliance landscape in mortgage lending.

Advocate's commitment goes beyond the routine; it's a proactive engagement with data that empowers us to identify trends, patterns, and areas for improvement. This insight-driven approach enables us to offer informed recommendations and innovative solutions, fostering a collaborative environment among borrowers, lenders, and insurance agents.

In essence, our commitment to data is a commitment to progress—a commitment to shaping a future where insurance compliance is streamlined, efficient, and responsive to the ever-evolving landscape of mortgage lending.

Methodology

Using Advocate’s extensive 12-month insurance review dataset, covering all approved loans for private lenders, we examine the relationship between insurance brokers and insurance approval timelines. The key metric under evaluation is the turnaround time on insurance compliance, representing the duration from the initial submission of a loan for insurance review to the final approval granted by Advocate.

To evaluate the impact of insurance brokers on turnaround timelines, we categorize agents as independent, who operate without ties to any specific agency or carrier, captive, who work for agencies other than the major five included in our analysis or affiliated with one of the major agencies: State Farm, Farmers, Allstate, Nationwide, and American Family Insurance.

In our analysis, we used Analysis of Variance (ANOVA), a statistical method that helps compare average compliance resolution timelines among different categories of insurance brokers. ANOVA determines whether the observed differences in approval timelines are statistically significant or just random chance.

By calculating the p-value associated with the ANOVA test, we assess the likelihood of these variations being meaningful. Rejecting the null hypothesis in this context would signify that there are significant differences in approval timelines between insurance broker categories. This provides valuable insights into their impact on insurance compliance approval timelines. The low p-value (< 0.001) indicates that these differences are unlikely due to random chance alone, rejecting the null hypothesis.

Additionally, we performed a box-plot analysis to reveal the variability within each broker category, adding depth to our analysis, to visualize the variations in turnaround times within each insurance agent category. This chart emphasizes the range – the span of turnaround times, as well as quartiles – divisions that capture the data's central tendencies and spread.

Conclusion

In summary, our analyses challenge conventional assumptions about insurance compliance timelines in mortgage lending. Part 1 debunked common delay factors, and Part 2 underscores the pivotal role of insurance brokers.

At Advocate, our commitment remains resolute: to continuously refine, adapt, and lead the charge toward a mortgage industry that thrives on efficiency, collaboration, and a profound understanding of its intricate dynamics. In doing so, we not only challenge assumptions but actively sculpt a progressive narrative for the evolving world of mortgage lending.